Benefit fraud is a criminal offence and is not the same as benefit overpayments. If you have been accused of benefit fraud, seeking proper benefit fraud legal advice is important. Benefit fraud law is a complex area, and our expert benefit fraud lawyers are here to advise.

What Is Classed As Benefit Fraud?

Benefit fraud is a type of fraud where a person has acted dishonestly or deliberately to claim benefits (often in the form of financial, medical or food assistance) to which they are not entitled. It is a criminal offence. If this comes to the attention of the office paying the benefit, an investigation for benefit fraud may follow.

Benefit fraud law can be confusing and highly damaging for those under investigation, so it’s important to seek professional benefit fraud legal advice as early as possible. A benefit fraud lawyer can help to advise and guide you through the process.

What Offences Does Benefit Fraud Law Cover?

Benefit fraud law encompasses a range of offences, including:

- Deliberately omitting information about your true financial situation to the benefits office when you claimed the benefit, such as working while claiming Jobseeker’s Allowance or failing to declare all savings (knowing a higher amount would affect entitlement to the benefit received).

- Deliberately omitting information about your true household situation to the benefits office when you claimed the benefit—for example, living with someone but claiming benefits as a lone parent.

- Deliberately failing to inform the benefits office about a change in financial, household or other circumstance that you knew would affect your benefit entitlement.

- Deliberately using false documents to claim benefits, for example, using a false birth certificate to claim Child Benefit.

Benefit Overpayment

Benefit fraud should not be confused with benefit overpayment, although the two sometimes overlap. They are not the same thing, and benefit overpayments can arise for various reasons, including error at the benefits office or accidental misrepresentation (such as not declaring a change because you didn’t reasonably know that it would affect your benefits). Benefit overpayments are not necessarily fraud but can run parallel to a fraud investigation.

If you believe you have been overpaid or your circumstances change, you must tell the relevant office to your benefit immediately. You may have to pay back any overpayment, and failure to disclose it could be considered a form of benefit fraud.

Why Is it Important to Seek Benefit Fraud Legal Advice?

The benefits system and criteria for eligibility can often be tricky to navigate. If you’re unsure, it is best to contact benefit fraud lawyers for proper benefit fraud legal advice.

Being under investigation for benefit fraud can be stressful and intrusive. Benefit fraud officers may contact your family, friends and other organisations who hold information about you, such as HMRC, banks, and gas and electricity providers. Following a benefit fraud investigation, the case might go to court.

Our dedicated blog post walks you through the benefit fraud investigation process, and our experienced benefit fraud lawyers can explain the process as well.

Interviews

If an individual is accused of benefit fraud, they may either be invited to an interview or told to attend court. Before attending an interview or court, any suspect is advised to consult benefit fraud lawyers so that the precise alleged offence is ascertained and benefit fraud legal advice given as to the appropriate form of action to take.

If the fraud investigators already think a benefit fraud offence has been committed, they are more likely to interview under caution. Anything said during this interview could then be used as evidence in court. This should be explained at the start of the interview.

Prosecutions

Following an investigation, an individual can be prosecuted for a number of offences. The allegation or allegations a defendant might face in these proceedings will vary depending on the factual background of the case and can range from failing to report employment status up to fraud conspiracy.

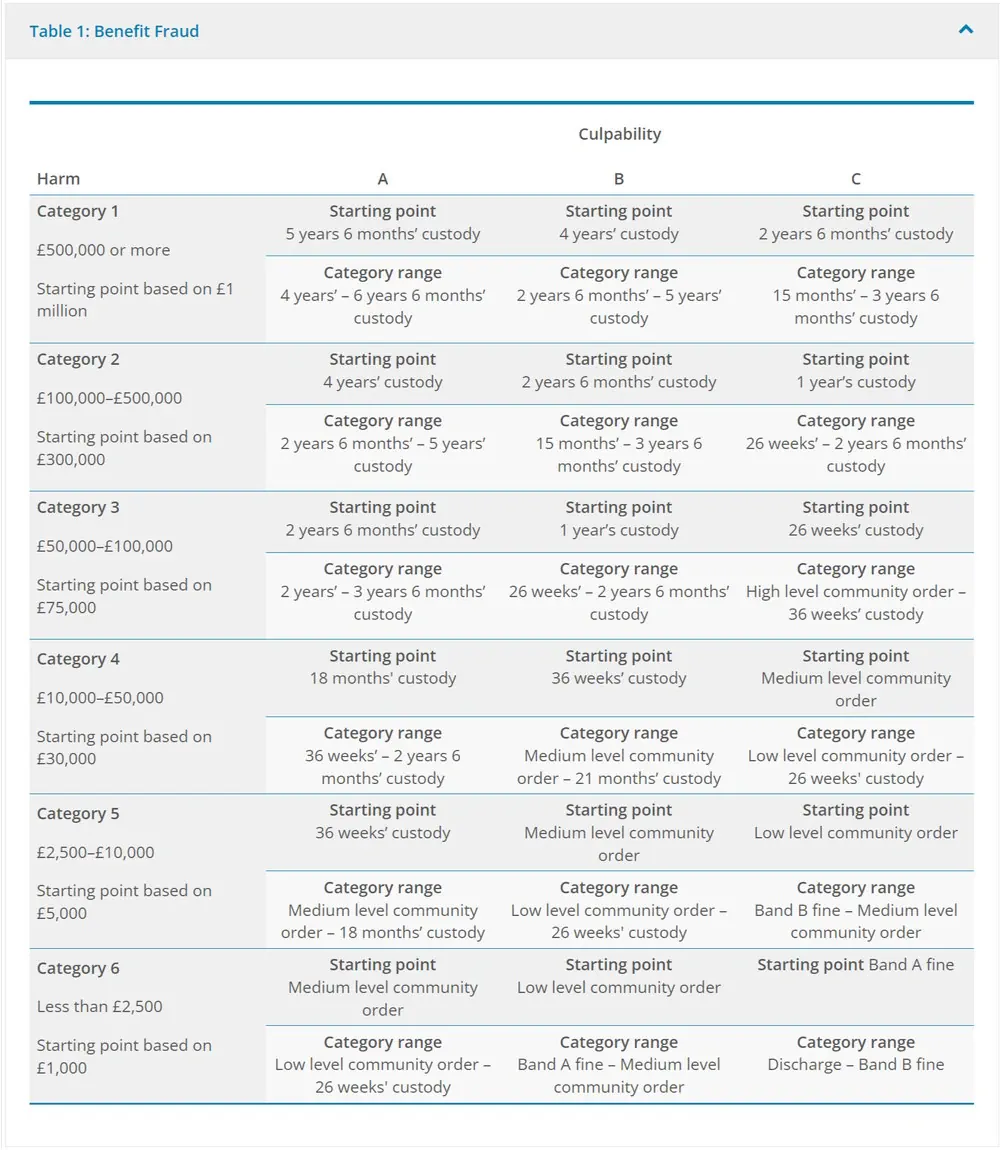

Benefit Fraud Sentencing

Benefit fraud is a serious offence, and this is reflected in its sentencing. If a defendant is convicted, then the court can hand down a sentence ranging from a fine up to and including a custodial sentence. After the sentence, where appropriate, the Prosecuting Authority may institute civil confiscation proceedings to deprive a convicted defendant of the amount they have gained from criminal activity.

So what is the punishment for benefit fraud? You risk being issued a substantial fine of up to £5000, being taken to court or having your benefits stopped or reduced for between 13 weeks to three years. You can go to jail for breaking benefit fraud law, but unless you are part of a large group conspiracy to defraud the system out of hundreds of thousands of pounds, it is unlikely.

If you do face jail time, the maximum prison sentence for benefit fraud is seven years. Your sentence will depend on the nature of the fraudulent activity – whether you were coerced into it or operated with a group. If the case progresses to court and you are convicted, this will be recorded on your DBS (previously known as a CRB).

Challenging the Amount of Overpayment

There is often a dispute over how any alleged fraud has been calculated, and there may be instances where expert evidence is obtained to examine the accuracy of overpayments alleged. The amount concerned is relevant to whether a decision is made to prosecute, the appropriate court to try the case, the sentence given and any subsequent confiscation proceedings.

Benefit Fraud Lawyers

For legal advice about benefit fraud, our benefit fraud lawyers are experienced and equipped to provide guidance. Contact us today for help with your client’s benefit fraud case.